why is pfizer stock so cheap

And finally it has a ton of debt weighing in at around 170 billion. It is cheap changing hands at a priceearnings ratio of just 144 at a time.

:max_bytes(150000):strip_icc()/1-d656e003d5bb4c5f849f55b3e2b4deb6.jpg)

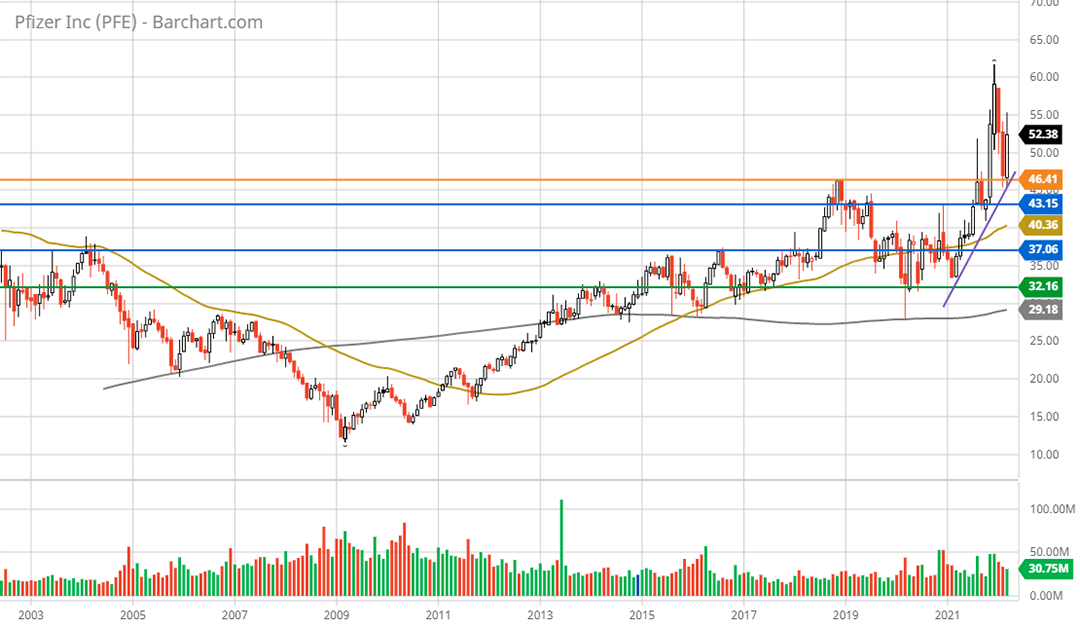

Pfizer Positioned For Future Upside

And the answer seems to be based on very real concerns about the Pfizer business.

. Because it will be the one that creates the REAL vaccine. That puts it looking pretty cheap right now based on the midpoint of the guidance its trading at 31 times 2021 sales and 111 times adjusted earnings guidance. Now lets address it.

Second the company has now gone five quarters without raising its dividend. Whats Next For Pfizer Stock. Analysts recommendations show a 12-month targeted price.

Trading at a forward price-to-earnings of around 125 times Pfizer trades in deep value territory. Moderna has no med that has been approved for distribution yet. Answer 1 of 5.

Pfizer stock traded down fractionally on Wednesday to 3395 in a 52-week range of 2788 to 4411. Those concerns have been around for a while now a key. Then on top of that you get a 3.

Until Vaxart reports data this is likely to continue. Ford closed Monday April 23 at 1104 down 106 year to date and deep in correction. Shares of Pfizer gained downside momentum after the company released its fourth-quarter earnings report.

Based On Fundamental Analysis. 16 and declined 24 to the 2018 low of 1014 on March 2. Analysts believed that Pfizer would report earnings of 673 per share in 2022 so the companys guidance of.

So all in all is PFE stock a buy. Shares of Ford traded as high as 1329 on Jan. Volatility spikes driven by news arent priced in.

Its actually 11 from what I see on yahoo. Thats a lot better than where Pfizer stock was in March but 2020 so far is yet another dismal year. By headhe fundamentalists selling out and lowering it during massive market booms it makes private investors think it sucks and they sell their positions.

Pfizer Stock Is Cheap Relative to Its Peers. The stock spent much of the last half-decade since 2016 in the 30 to 35 range. Pfizer is a much bigger company with numerous meds on the market and others in the pipeline.

The company reported revenue of 2384 billion and adjusted earnings of 108 per share. So a few reasons why their pe is so low. The question however is why Pfizer stock seems so cheap.

As of March 2021 Pfizer had orders for 122 billion doses and with this new order of 18 billion doses from the EU total orders of. Shares of the big drugmaker are still down close to 5 year to date. First T stock is down big this year off 273 in 2020 while the SP 500 is up 155.

The top 5 best stocks to buy for 2022 that are all under 5. Its a yield company as in their revenue is no longer growing so you are looking at it from a yield perspective and in this environment that means dividend as earnings is fairly volatile. The stock has ebbed and flowed roughly between the mid-20s to mid-30s for the last five years.

For example PFE trades at a forward price-earnings ratio of. This is hurting the shares. A perfect storm has battered the New York-based drug makers fortunes of late with rising concerns surrounding President Joe Bidens Medicare cost cutting plans uncertainty over the need for Pfizers Covid.

So when it finally does pop there is more money to be made by big firms. Why Is Pfizer Stock So Low. In this Motley Fool Live video recorded on Aug.

The stock fell 25 in the following two trading sessions. PFE is now cheaper than its drug stock peers. Pfizer is expected to grow its annual adjusted earnings-per-share by roughly 10 over the next few years.

Pfizer is a Public Limited Company incorporated under the Indian Companies Act 1913 having its registered office in Mumbai Maharashtra and is listed on the BSE Limited and the National Stock Exchange of India Limited Pfizer Ltd. Pfizers dividend is attractive. And that forecasted performance.

In the first quarter adjusted Pfizer earnings were 162 per share on. Implied Volatility on Pfizer shares in the 3rd percentile is at the same level as it was before the Covid-19 vaccine. They do have quite a few programs in clinical trials and a total of 20 developmental candidates.

Ad Our Strong Buys Double the SP. In 2019 Pfizers shares. 4 Motley Fool contributors Keith Speights and Brian Orelli answer a viewers question about why investors might.

All of this considered Argus makes a compelling case for Pfizer. One reason to buy Pfizer stock is its lush dividend yield of 425 more than double that of the SP 500. Currently analysts expect that Pfizer will report earnings of 412 per share in 2021 and 359 per share in 2022 so the stock is trading.

Shares in the American pharmaceutical corporation Pfizer PFE are currently trading 17 down from their all-time August closing highs of 5042. The consensus price target. Ad Five Under-The-Radar Investments You Cant Afford to Miss.

The Pfizer stock has improved by nearly 44 in the last 12 months and the analysts estimate the stock has a potential to return 120.

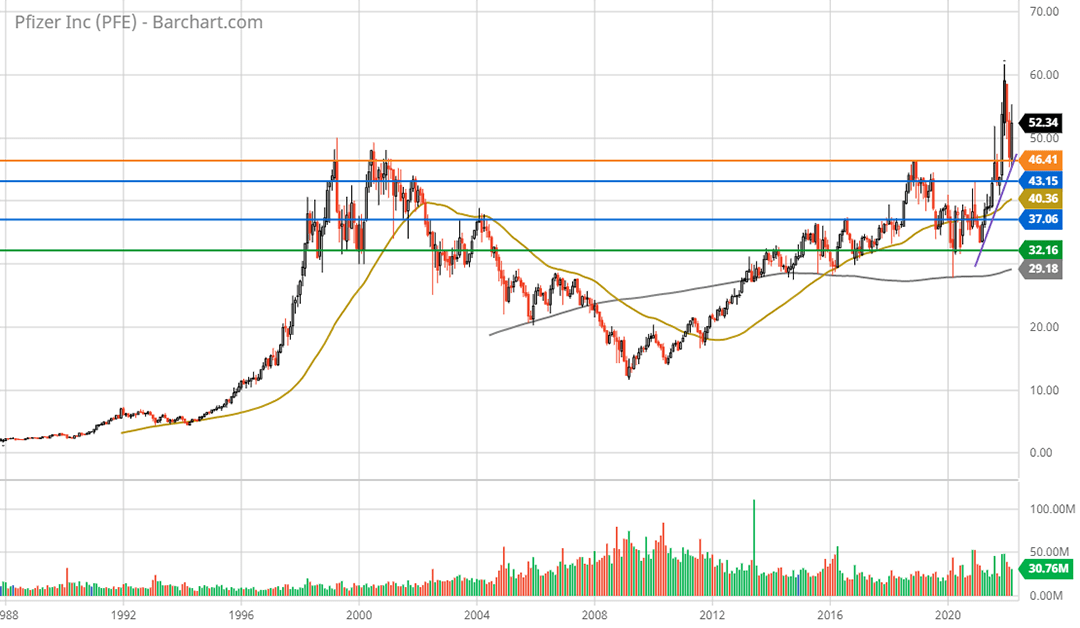

Pfizer Pfe How It Could Double Seeking Alpha

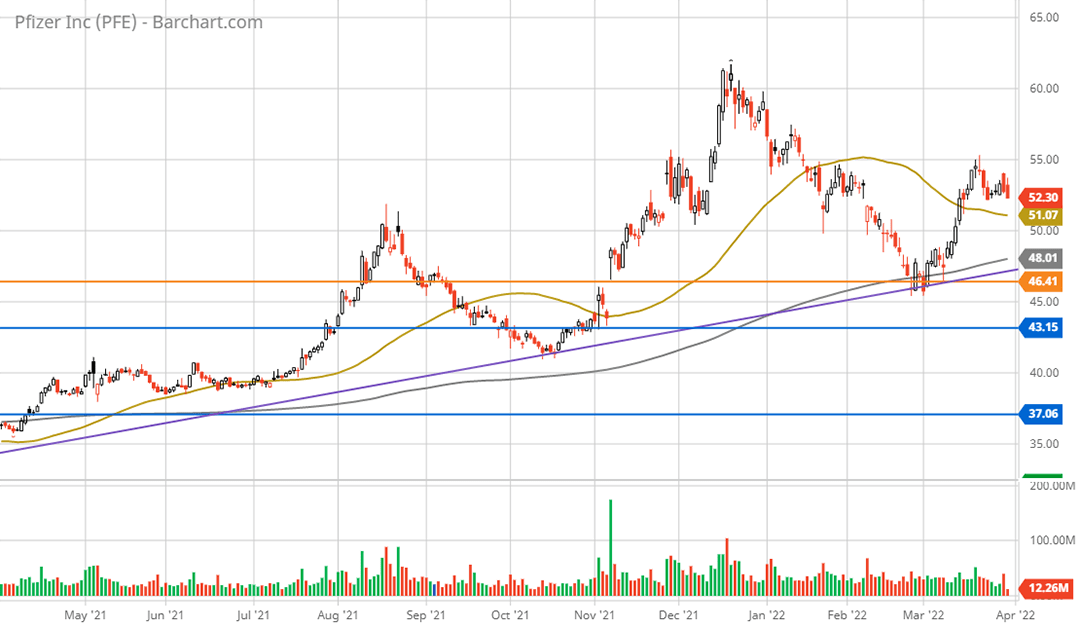

Does The Current Dip In Pfizer Stock Offer A Buying Opportunity

Pfizer Vs Merck Stock Battle Between Giants During Pandemic Seeking Alpha

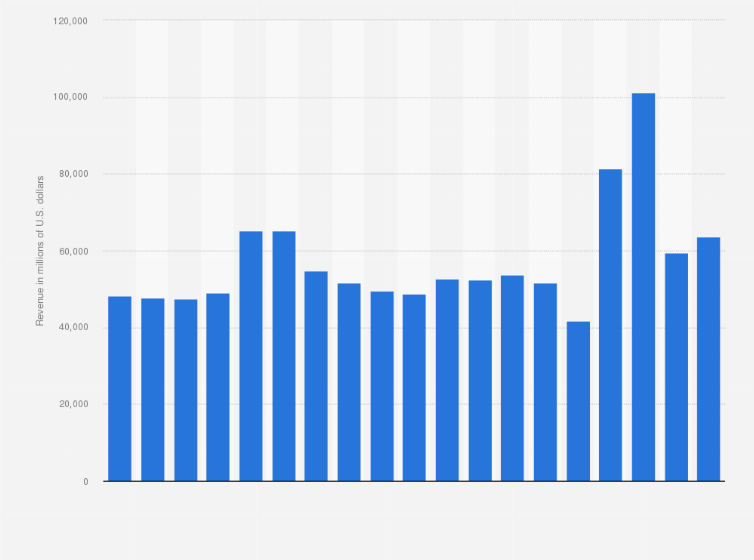

Pfizer Total Revenue 2006 2021 Statista

How To Buy Pfizer Pfe Stock Forbes Advisor

Pfizer Stock Price And Chart Nyse Pfe Tradingview

Pfizer Pfe How It Could Double Seeking Alpha

Pfizer Stock Is Pfe Stock A Buy As 2022 Covid Vaccine Sales Appear Front Loaded Investor S Business Daily

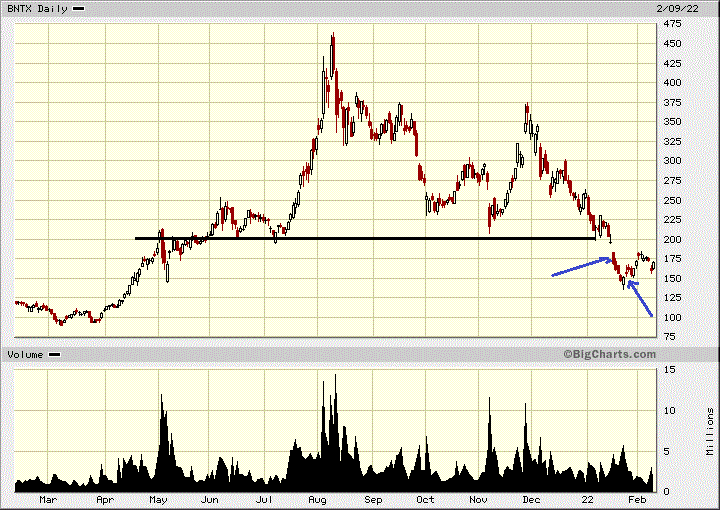

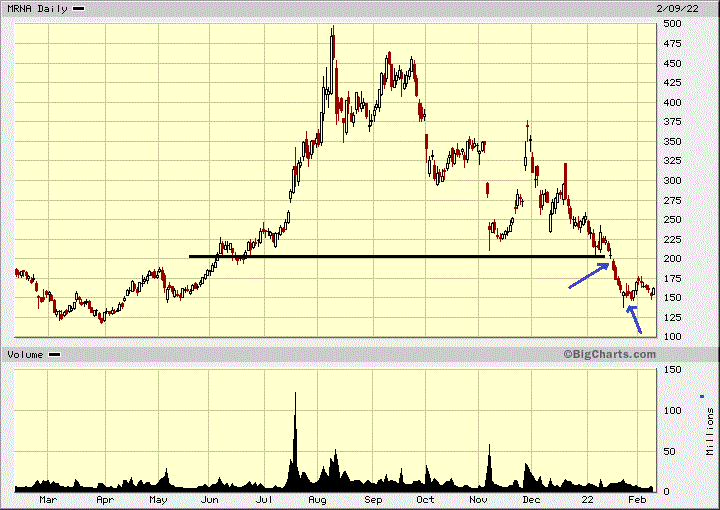

Pfizer Pfe Likely Next Mrna Based Stock To Tumble Seeking Alpha

:max_bytes(150000):strip_icc()/4-6d6ad667049442be82eba9859b909770.jpg)

Pfizer Positioned For Future Upside

Pfizer Stock Price And Chart Nyse Pfe Tradingview

Pfizer Pfe Likely Next Mrna Based Stock To Tumble Seeking Alpha

Pfizer Stock Price And Chart Nyse Pfe Tradingview

Pfizer Pfe How It Could Double Seeking Alpha

:max_bytes(150000):strip_icc()/3-3a4c5d6eab9c47f9a0cca1daa0f78c42.jpg)

Pfizer Positioned For Future Upside

Pfizer Stock History How The Drugmaker Became An Industry Giant The Motley Fool