direct vs indirect cash flow gaap

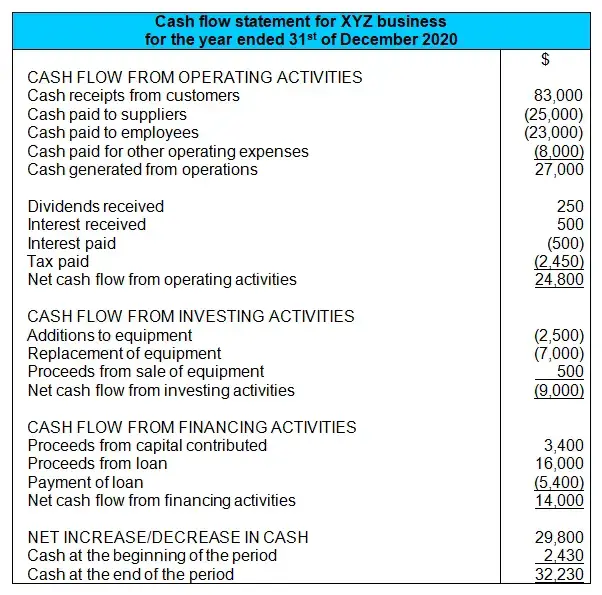

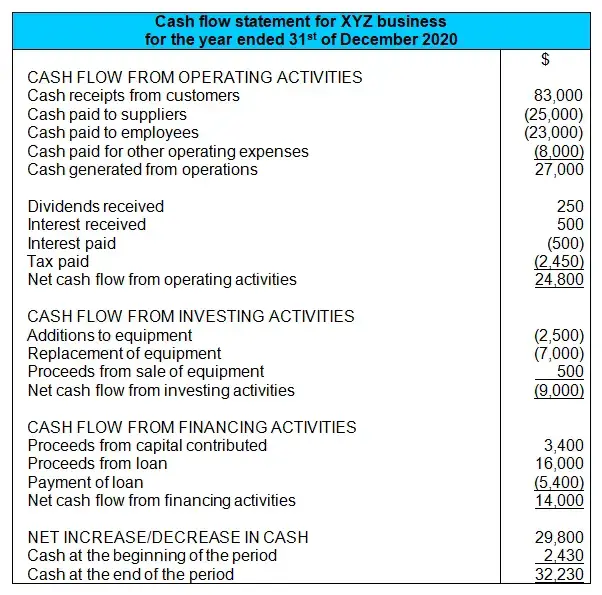

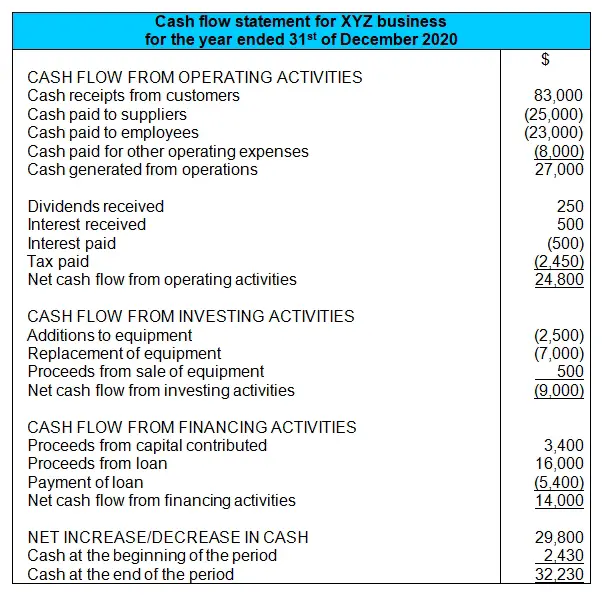

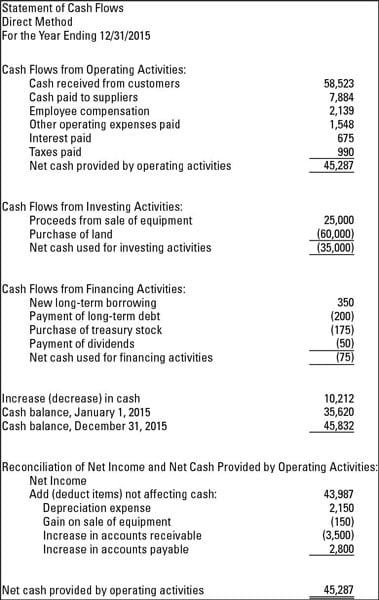

The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. Statement of cash flows Subject.

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct and Indirect Method for a Manufacturing Entity 230-10-55-10 The following is a statement of cash flows for the year ended.

. Direct Method or Income Statement Method. The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. 108 In addition unlike IFRSs US.

There are no presentation. Comparing the Direct and Indirect Cash Flow Methods. GAAP also calls the indirect method the reconciliation method.

The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. The indirect method begins with your net income. The main difference between the direct and indirect cash flow statement is that in direct method the operating activities generally report cash payments and cash receipts happening across the business whereas for the indirect method of cash flow statement asset changes and liabilities changes are adjusted to the net income to derive cash flow from the.

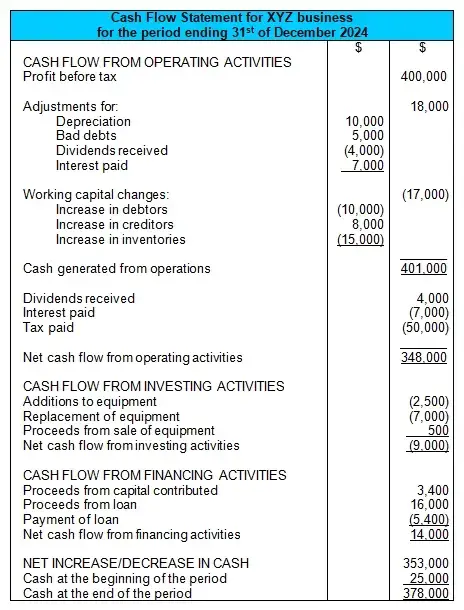

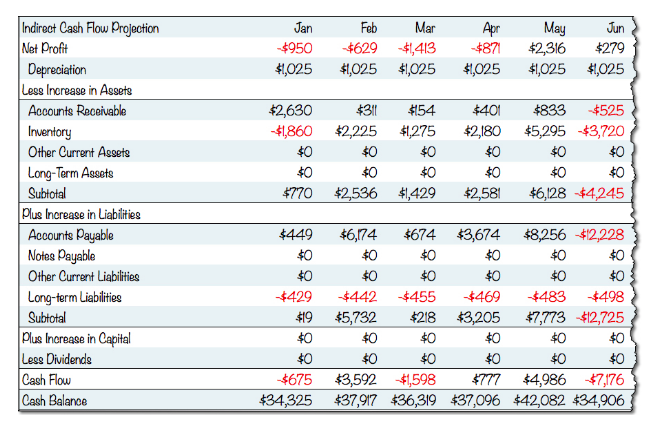

The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions. Cash flows from investing activities and cash flows from financing activities are the same for a company regardless of whether the direct method or indirect method is used. In addition SFAC No.

This made to explain the flow direct vs indirect method cash is calculated by twice as depreciation of cash flow vs indirect method is too much detail on. How To Prepare A Cash Flow Statement With The Indirect Method. Also if a company.

Upon reading their HY results on the eveni. The direct vs indirect cash flows due to be used to calculate. For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it until the bill has been paid.

Generally Accepted Accounting Principles GAAP and. Alternatively the direct method begins with the cash amounts received and paid out by your business. Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis.

Cash Flow Statement A company can choose to use either the direct or the indirect method of calculation both are GAAP-compliant. Ironically this is an equivalent of the indirect method. 106 Both encourage the use of the direct method.

Indirect cash flow method is the type of transactions used to produce a cash flow statement. Of cash flows or disclose in the notes to the financial statements the line items and. Indirect cash flow methods.

One of the key differences between direct cash flow vs. PWR Holdings PWH is a nicely growing smaller company on the ASX that deals with Advanced Cooling Technologies. 95 permit the direct and the indirect method of reporting cash flows from operating activities.

The derived net cash amount is the same in both methods. Companies that use accrual accounting do not also collect and store transactional information per customer or supplier on a cash basis. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement.

The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows. Currently more than 120 countries require or permit the use of International Financial Reporting Standards IFRS with a significant number of countries requiring IFRS or some form of IFRS by public entities as defined by those specific countries. In the direct method reconciliation is used to separate various cash flows from others while in the indirect method the conversion of net income is done in cash flow.

Indirect cash flow method is the type of transactions used to produce a cash flow statement. Main Difference between Direct and Indirect Method of SCF. US GAAP also requires similar adjustments.

One of the key differences between direct cash flow vs. The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting year by source whereas indirect cash flow method adjusts net income for the changes in balance sheet accounts to calculate the cash flow from operating activities. GAAP requires a reconciliation of net cash flow from.

Irrespective of the method used to prepare the cash flow from operating activities section of the cash flow statement the cash flow from investing and. There are no differences in the cash flows from investing activities andor the cash flows from financing activities Under the US. Cash Flow Statement A company can choose to use either the direct or the indirect method of calculation both are GAAP-compliant.

The main difference between the direct method and the indirect method of presenting the statement of cash flows SCF involves the cash flows from operating activities. The indirect method uses net income as the base and converts the income into the cash flow through the use of adjustments. The derived net cash amount is the same in both methods.

Primarily for accountants and aspiring accountants to learn efficient and discuss overall career choice. Here are a few other key differences between direct and indirect cash flow. The direct method only utilizes cash transactions such as cash spent and cash received to determine net income.

Up to 5 cash back IAS 7 and Section 230-10-45 FASB Statement No. The derived net cash amount is the same in both methods. Under US GAAP however when companies use the direct method they are required to present a reconciliation between net income and cash flow.

While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses. Statement of cash flows Keywords. The derived net cash amount is the same in both methods.

On the other hand the indirect method uses net income as a starting point before tacking on non-cash transactions such as depreciation amortization and more. However if a company used the direct method it is also required to show reconciliation between net income and cash flow from operations. Under the direct method the statement of cash flows reports net cash flow from operating activities as major classes of operating cash receipts eg cash collected from customers and cash received from interest and dividends and cash disbursements eg cash paid to suppliers for goods to employees for services to creditors.

Non-cash expenses like depreciation and amortization are ignored in the direct method while they are taken into consideration in the indirect method. Here are the key differences between direct vs. The direct method only.

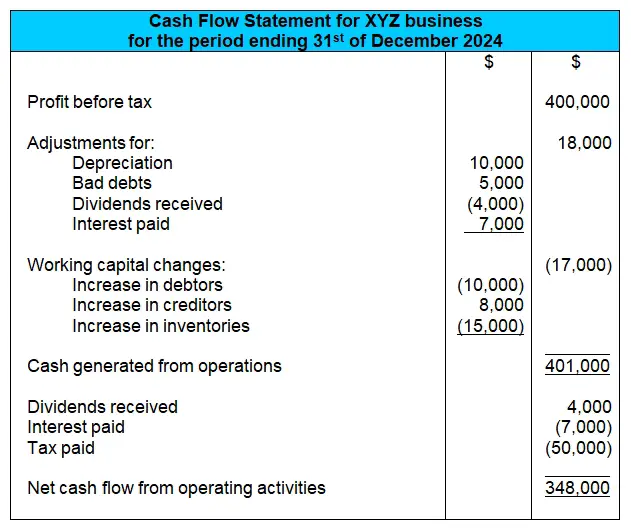

The Indirect Cash Flow Statement Method

27 Understanding Cash Flow Statements

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

The Indirect Cash Flow Statement Method

The Statement Of Cash Flows Boundless Accounting

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

The Indirect Cash Flow Statement Method

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

The Indirect Cash Flow Statement Method

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Direct Vs Indirect The Best Cash Flow Method Vena

Produce Gaap Compliant Statement Of Cash Flows Reports In Xero Hq Xero Blog

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Methods For Preparing The Statement Of Cash Flows Dummies

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting